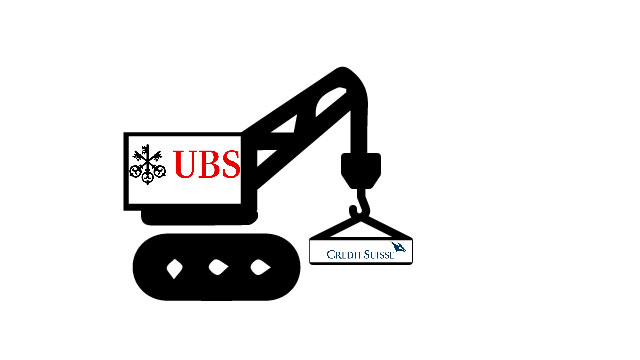

Reports suggest UBS AG has been considering buying out its troubled Swiss rival Credit Suisse on Saturday. If this bid is successful, this would allay concerns that the growing banking crisis could destabilise the global financial system, controlled by western institutions. The 167-year-old Credit Suisse happens to be one of the largest financial corporations that suffered due to the market turbulence caused by the collapse of the US-based Silicon Valley Bank (SVB) and Signature Bank.

It has been reported that UBS has been under the Swiss government’s pressure to acquire its regional competitor to quell the forthcoming financial turbulence in Europe and the world. The acquisition strategy could entail Credit Suisse’s Swiss company being protected from the dangers by a guarantee from the Swiss government, while it spun off.

The financial authority for Switzerland, FINMA, Credit Suisse, and UBS didn’t comment on the news.

It has been reported that Credit Suisse’s chief financial officer (CFO) Dixit Joshi and other management team members met over the weekend to discuss their options for the bank, and there were numerous rumours of competitor interest.

While Bloomberg claimed that Deutsche Bank was considering the chance of purchasing some of Credit Suisse’s assets, American financial juggernaut BlackRock stated that it had no intentions for or interest in making a competing offer for Credit Suisse.

This week, Credit Suisse’s stock price fluctuated dramatically, forcing it to use $54bn in central bank financing.

Switzerland—long regarded as a model of financial security—was in a reflective mood as executives debated the direction of the largest lenders in the country.

As one of the biggest asset managers in the world, Credit Suisse is regarded as one of the 30 crucial global financial institutions whose collapse would have an impact on the entire financial system.

Around four of Credit Suisse’s direct competitors, including Societe Generale SA and Deutsche Bank AG, have restricted their transactions involving the Swiss bank or its securities, reported news agency Reuters. As Credit Suisse’s future is unclear, Goldman Sachs has lowered its recommendation on exposure to European bank debt, arguing that this will place pressure on the region’s larger financial industry.