The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has unanimously decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.5% during its second bi-monthly meeting of the financial year (FY) 2023-24, which took place from June 6th to June 8th. The decision of the RBI’s monetary policy meeting was published on Thursday, June 8th.

In a press release, the central bank said that the standing deposit facility (SDF) rate will also remain unchanged at 6.5%. The MPC has decided to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth.

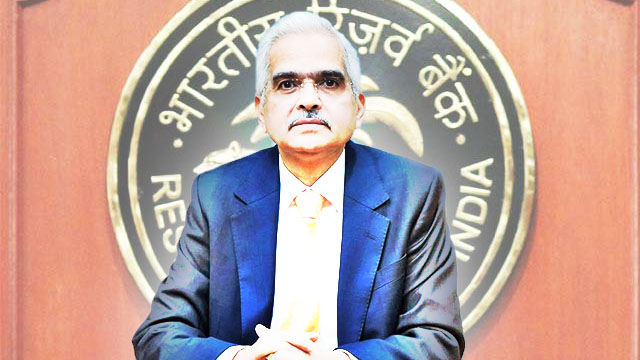

The RBI’s monetary policy decision has evoked mixed responses. While several bankers see it as a liberal approach by the central bank, the stock markets responded negatively after RBI Governor Shaktikanta Das informed that one shouldn’t look for rate cuts in the entire FY 2023-24. This flagged inflation concern, due to which the Sensex fell 170.44 points drop, or 0.27%, to 62,972.52. The Nifty traded 63.10 points, or 0.34% lower, at 18,663.30.

“The MPC recognised that the pace of global economic activity is expected to decelerate in 2023, dragged down by elevated inflation, tight financial conditions and geopolitical tensions. The pace of monetary tightening has slowed in recent months, but uncertainty remains on its future trajectory as inflation continues to rule above targets across the world”, Das commented on the RBI’s monetary policy stance.

The RBI governor also said, “The MPC will continue to remain vigilant on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and bring down inflation to the target.”

The RBI’s monetary policy meeting also stressed that the inflation trajectory will be shaped by food prices in the days to come. It’s hopeful that good cultivation may ease grain prices, following an indication of a normal south-west monsoon by the India Meteorological Department (IMD), however, there was concern over the price of milk, which will not ease due to the rising cost of fodder.

According to the RBI, global factors, including banking sector stress and geopolitical tensions, will impact India’s economic performance in FY 2023-24. Real GDP growth for FY 2023-24 is forecasted at 6.5% – 8% in Q1, 6.5% in Q2, 6% in Q3 and 5.7% in Q4. Despite remaining sceptical about rural growth, the RBI expressed hope due to the growth of urban demand.

Taking note of the consumer price index (CPI) inflation’s moderation during March-April 2023 into the tolerance band, the RBI monetary policy meeting claimed that this moderation reflects the success of its policies, including monetary tightening and supply augmenting measures.

The RBI monetary policy meeting also estimated that though the CPI inflation has moderated in FY 2023-24 vis-à-vis 2022-23, it remains above the target and warrants continuous monitoring. Thus, due to this cautious approach, the RBI’s monetary policy couldn’t be relaxed and the rates were not lowered.

The RBI has projected CPI inflation at 5.1% for FY 2023-24. The Q1 CPI inflation is projected to be 4.6%, Q2 5.2%, Q3 5.4% and Q4 5.2%.

According to the central bank, the members of the MPC—Governor Das, Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Rajiv Ranjan and Michael Debabrata Patra—unanimously voted to keep the policy repo rate unchanged at 6.5%.

However, Varma expressed his reservation regarding the resolution to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. The RBI’s monetary policy will be next reviewed by the MPC from August 8th to August 10th.