Bangladesh’s budget for 2025-26 reveals the stark reality facing South Asia’s second-largest economy.

The interim government presented a Tk7.9 trillion ($64.81bn) budget on June 2nd that prioritises debt servicing over public welfare.

Bangladesh’s suspended Jatiya Sangsad remains dissolved following the mass protests. Therefore, the televised presentation took place without parliamentary scrutiny.

Finance Adviser Salehuddin Ahmed delivered the budget speech titled “Building an Equitable and Sustainable Economic System”.

The irony was not lost on observers.

According to critics, the budget failed to get out of the Awami League era’s shadow and fulfil any larger public aspirations.

Bangladesh’s budget for 2025-26 reflects deep structural imbalances that have plagued the country since the August 2024 uprising ousted Sheikh Hasina‘s government.

Bangladesh’s budget 2025-26: Debt servicing devours public resources

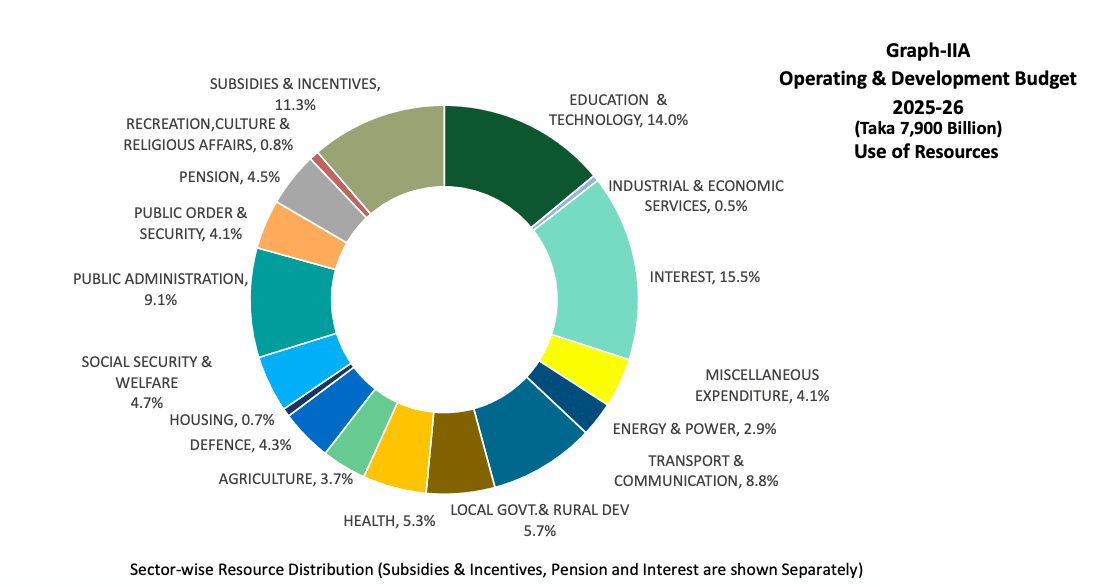

The most troubling aspect of Bangladesh’s budget for 2025-26 lies in its expenditure priorities.

Interest payments on domestic and foreign borrowings consume 15.5% of total spending.

This represents the single largest budget item, surpassing allocations for healthcare, education and agriculture combined.

Subsidies and incentives account for 11.3% of expenditure.

Healthcare receives a meagre 5.3% allocation.

Agriculture, which employs nearly half the population, gets just 3.7% of budget resources.

The expenditure structure reveals a government trapped by past borrowing decisions.

Public administration absorbs 10.2% of the budget, rising one percentage point from the previous year.

The interim government proposed increased special benefits for civil servants to address demands for dearness allowances.

Mr Ahmed projected an overall income of Tk5.64 trillion.

The National Board of Revenue expects to contribute 88.4% through direct taxes, duties and value-added tax.

This revenue target appears highly ambitious given Bangladesh’s limited fiscal capacity.

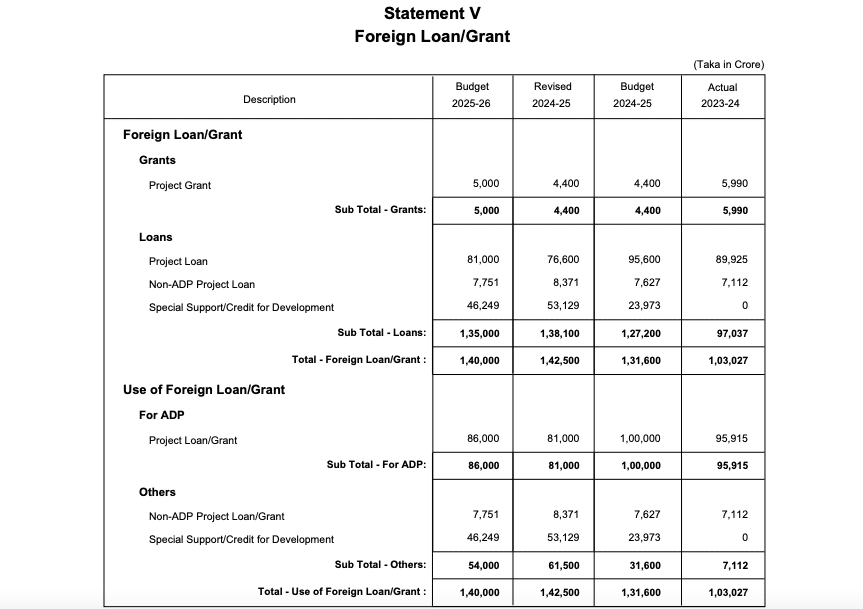

Yet the debt burden continues growing.

The government plans to borrow Tk960bn from external sources and Tk1.25 trillion domestically.

These borrowings will finance a budget deficit of 3.6% of projected GDP.

Industrial policy shifts create uncertainty

Bangladesh’s budget for 2025-26 introduces significant tariff changes ahead of the country’s graduation from least developed country status in November 2026.

The government reduced duties on refined sugar, petroleum products, buses, minibuses and military equipment, including guns, mortars and rocket launchers.

Conversely, duties increased on cosmetics, toys, mobile phones and door locks.

The tariff rationalisation aims to prepare domestic industries for heightened international competition.

However, economists warned these measures could force many local businesses to face tougher competition.

The finance adviser cancelled corporate tax and value-added tax exemptions for industries.

He also limited the undisclosed money investment facility in land and property.

These changes require investors to declare funding sources and face steeper taxes.

The measures reflect attempts to broaden the tax base whilst preparing for economic graduation.

But they also signal the interim government’s struggle to balance revenue generation with industrial protection.

Political opposition condemns traditional approach

Political parties across the spectrum criticised Bangladesh’s budget for 2025-26 as lacking vision and innovation.

The Bangladesh Nationalist Party’s (BNP) standing committee member Amir Khasru Mahmud Chowdhury termed it “a continuation of failed policies”.

“There is a fundamental disconnect between revenue generation and expenditure. The structural imbalance will only deepen, placing a burden on future governments,” Mr Chowdhury warned.

The BNP official questioned the interim government’s legitimacy to present such a large budget without an electoral mandate.

The Communist Party of Bangladesh (CPB) echoed these concerns.

In a joint statement, CPB chairman Mohammad Shah Alam and general secretary Ruhin Hossain Prince described the budget as “traditional and lacking bold economic vision”.

They predicted that the 6% growth target would fall to around 3% due to insufficient focus on employment generation.

The Bangladesh National Awami Party, led by Jabel Rahman Ghaani and Golam Mostafa Bhuiyan, also labelled the budget “traditional”.

They criticised reduced allocations and the absence of people-centric policies.

Jatiyo Samajtantrik Dal general secretary Shahid Uddin Mahmod Shapon acknowledged positive steps but demanded more effective measures to address the economic crisis.

Revolutionary Workers Party general secretary Saiful Huq called it “a disappointing narrative of a dreamless journey”.

Expert analysis reveals fundamental flaws in Bangladesh’s budget 2025-26

Economists offered mixed assessments of Bangladesh’s budget for 2025-26, with most expressing concern about its feasibility.

Speaking to Bangladeshi media, Zahid Hussain, a former World Bank Dhaka office chief economist, observed that revenue targets were “highly ambitious”.

He warned that shortfalls would force the government to downsize the budget or increase borrowings.

Bangladeshi media reported that Mr Hussain found the expenditure side “almost usual” compared to previous years.

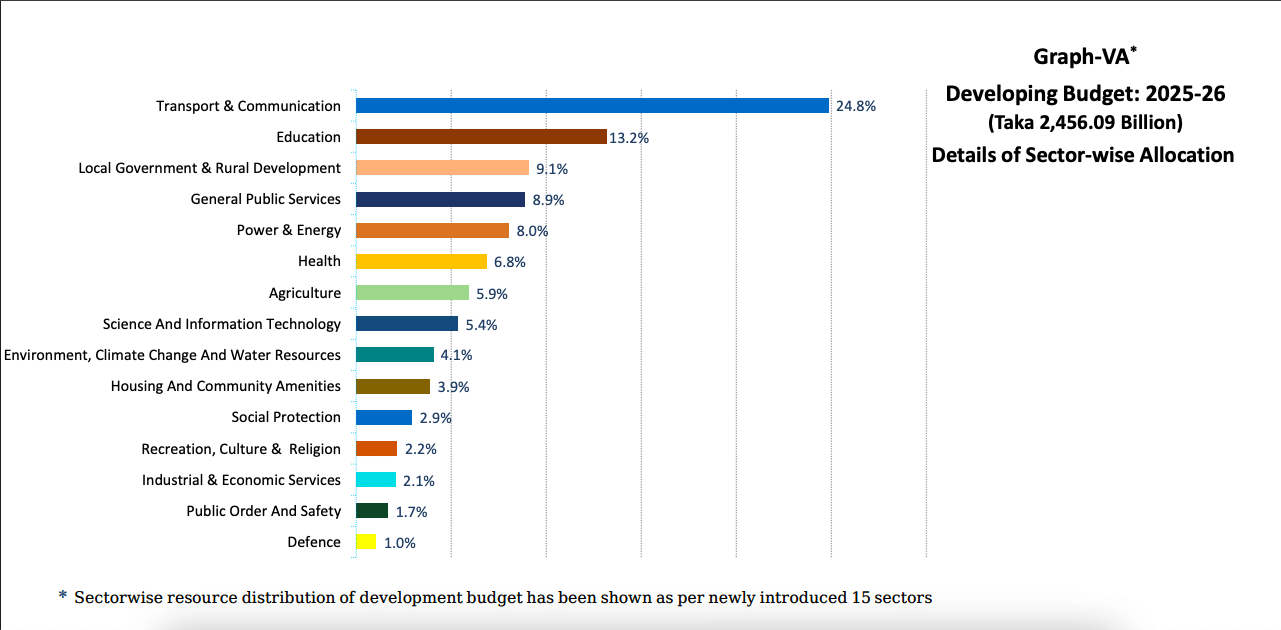

The smallest budget deficit in a decade resulted largely from a reduced annual development programme worth Tk2.3 trillion.

Selim Raihan, executive director of the South Asian Network on Economic Modelling, acknowledged the finance adviser’s realistic tone.

However, he criticised the budget’s traditional framework and limited policy changes, Bangladeshi media reported.

“The responses are fragmented and limited,” Mr Raihan said, noting the absence of concrete policy guarantees for creating an investment-friendly environment.

M Masrur Reaz, chairman of Policy Exchange Bangladesh, called the smaller budget size “prudent” under current macroeconomic constraints.

Yet he questioned the ambitious revenue target’s feasibility and doubted the 6.5% inflation target’s achievability.

Meanwhile, Mustafizur Rahman from the Centre for Policy Dialogue criticised the government’s failure to raise tax-free income thresholds despite persistent inflation.

He termed the modest tax-to-GDP ratio target of 10% by 2035 “disappointing”.

Growth targets face credibility gap

Unlike previous budgets, the finance adviser avoided direct GDP growth, inflation and private investment projections in his speech.

The “Medium-Term Outlook of Bangladesh Economy” separately projected 5.5% GDP growth, 6.5% inflation and 24.31% private investment for the financial year 2026.

These targets appear disconnected from ground realities.

The interim government has struggled to restore investor confidence following political upheaval.

Deteriorating law and order situation, attacks on political opponents and religious minorities, as well as a gradual aggrandisement of Islamists in national politics, have cast doubts over Bangladesh’s economic prospects.

Due to these, private investment remains stagnant while unemployment, particularly youth unemployment, continues to rise.

The annual development programme’s reduction to Tk2.3 trillion reflects fiscal constraints but also limits growth potential.

The government prioritised “economically viable projects” while focusing on implementation rates and quality.

This cautious approach may preserve fiscal discipline, but it constrains economic expansion.

Mr Ahmed sanctioned Tk4.05bn for martyrs and injured persons from the July 2024 uprising.

He also proposed higher allocations for social safety nets and subsidised food distribution.

These measures address immediate social needs but fail to tackle structural unemployment and inequality in the long run.

Missed opportunities for systemic reform

Bangladesh’s budget for 2025-26 represents a missed opportunity for fundamental economic restructuring.

The student-led uprising that toppled the previous government demanded radical changes to address inequality and unemployment, among others.

Yet the budget largely maintains existing frameworks.

Education and health allocations remain inadequate despite public demands for increased social spending.

The interim government’s technocratic approach prioritised fiscal prudence over transformative policies.

This conservative stance may preserve short-term stability but fails to address underlying structural problems.

The heavy reliance on borrowing to finance deficits perpetuates the debt trap.

Interest payments now consume more resources than productive investments in health, education or infrastructure. This pattern reflects the broader crisis of developing economies caught between fiscal constraints and development needs.

International financial institutions typically praise such “responsible” fiscal management.

Yet for ordinary Bangladeshis facing inflation and unemployment, the budget offers little hope for meaningful improvement.

The interim government’s legitimacy rests partly on delivering economic relief that this budget fails to provide.

The upcoming graduation from least developed country status will remove preferential trade access and aid eligibility.

Bangladesh’s budget for 2025-26 shows little preparation for this transition beyond modest tariff adjustments.

The economy requires deeper structural reforms to compete in middle-income markets.

Without addressing fundamental issues of inequality, unemployment and productive capacity, Bangladesh risks prolonged stagnation.

The budget’s emphasis on debt servicing over development investment suggests the country remains trapped in patterns established by previous governments.

True economic transformation will require more courage than this interim administration has demonstrated.

Join our channels on Telegram and WhatsApp to receive geopolitical updates, videos and more.