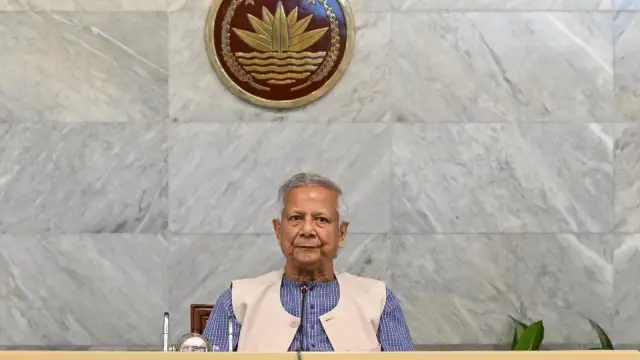

Bangladesh’s economy has demonstrated remarkable stability and recovery following the July Revolution that ousted Sheikh Hasina on August 5th, 2024, with Muhammad Yunus‘s interim government achieving foreign reserves recovery from crisis levels of $20.39bn to over $31bn and inflation reduction from 12% to 8.48% within one year. Despite facing unprecedented political transition, devastating floods, and international rating downgrades, the country has maintained economic momentum through pragmatic reforms and strong international support, though growth projections remain conservative at 3.3-3.9% for the financial year (FY) 2024-25 (calculated from July 1st to June 30th), as institutions prioritise stability over rapid expansion.

The interim government’s swift implementation of banking sector reforms, monetary policy adjustments, and anti-corruption measures has restored confidence among international partners, securing $6bn in new multilateral funding while successfully negotiating trade disputes. However, significant structural challenges persist, including a $1.2bn agricultural sector loss from the August 2024 floods, energy sector debt of Tk 290bn, and the upcoming LDC graduation transition scheduled for November 2026. The combination of emergency economic management with systematic institutional reforms positions Bangladesh for sustained recovery, contingent on a successful democratic transition by 2026.

Macroeconomic foundations strengthen amid transition

Bangladesh’s core economic indicators have stabilised faster than expected under the Mr Yunus administration.

GDP growth achieved 3.9% in FY 2024-25, significantly below the pre-revolution projection of 5.7% but representing successful damage control during unprecedented political upheaval.

The World Bank and IMF both revised their forecasts downward—to 3.3% and 3.76% respectively—reflecting cautious optimism about the interim government’s management capabilities.

The most striking success has been foreign exchange reserves.

From the crisis level of $20.39bn on July 31st 2024, reserves rebounded to over $31bn by June 2025, driven by 80% year-on-year increases in remittances and improved export earnings.

This recovery enabled Bangladesh Bank to halt dollar sales from reserves and stabilise the currency within a managed range of Tk 119.48-123.91 per USD.

Inflation control represents another key achievement

The interim government brought down general inflation from a 12-year peak of 11.66% in July 2024 to 8.48% by June 2025 through coordinated policy measures, including halting money printing for government loans, raising policy interest rates, and enhanced oversight of business cartels. The government’s conservative FY 2025-26 budget of Tk 7.90 trillion—Bangladesh’s first budget reduction in history—reflects fiscal discipline priorities, with the budget-to-GDP ratio falling to 12.65%, the lowest in 15 years.

Sustainable debt management

Debt management remains sustainable with government debt-to-GDP rising to 26.6% and external debt at approximately 22% of GDP. This positions Bangladesh favourably compared to regional peers like Pakistan and Sri Lanka. The interim government has prioritised social safety net expansion to over 17% of total spending while maintaining essential subsidies during the transition period.

Trade sector demonstrates remarkable recovery momentum

Bangladesh’s trade performance exceeded expectations despite the severe disruptions during July-August 2024. Total exports reached $50bn in 2024, representing 8.3% year-on-year growth, with December 2024 recording the highest monthly performance at $4.62bn since March 2024. This recovery trajectory continued into 2025, with H1 FY 2024-25 exports totalling $24.53bn, up 12.84% from the previous year.

The ready-made garments (RMG) sector maintained its dominant role with exports of $38.48bn—7.23% growth— accounting for 81.3% of total exports. Despite some concern about over-concentration, the sector’s resilience was remarkable; 99.26% of factories in key industrial zones returned to full operation by late 2024. Knitwear exports grew 13.01% to $10.83bn while woven garments increased 13.60% to $9.05bn, demonstrating strong international buyer confidence in Bangladesh’s production capabilities.

Momentum in export diversification

Export diversification gained momentum across multiple sectors. Non-leather footwear exports surged 39.10% to $273.89m, leather goods grew 10.44% to $577.29m, and agricultural products increased 9.31% to $595.51m. However, the economy still faces the challenge of RMG over-dependence, with non-RMG exports experiencing -3.8% growth in H1 FY24.

The US trade relationship required intensive diplomatic management following the imposition of 37% reciprocal tariffs in April 2025.

Through sustained negotiations led by Commerce Adviser Sheikh Bashir Uddin, Bangladesh successfully reduced the tariff to 20%, though further negotiations continue.

Mr Yunus’s office praised the negotiation on a social media post, projecting it as a new Bangladesh’s resilience.

Chief Adviser's message after successful tarriff negotiations with US

— Chief Adviser of the Government of Bangladesh (@ChiefAdviserGoB) August 1, 2025

Dhaka, August 1, 2025: We proudly congratulate the Bangladesh tariff negotiators on securing a landmark trade deal with the United States, a decisive diplomatic victory.

By reducing the tariff to 20%, 17…

The interim government secured agreements for increased US imports, including wheat, LNG, cotton, and soybeans, plus orders for 25 Boeing aircraft, demonstrating pragmatic economic diplomacy.

Financial sector undergoes comprehensive reform

The banking sector has experienced the most dramatic transformation under the interim government.

A new Bangladesh Bank governor, Ahsan Mansur, a former IMF economist, handpicked by Mr Yunus, leads comprehensive reforms alongside a six-member banking task force established in September 2024.

The task force includes prominent figures like Lutfey Siddiqi and Zahid Hussain, signalling a serious commitment to international best practices.

Structural banking reforms include reconstituting the boards of 11 troubled banks, launching comprehensive asset quality reviews, and implementing independent board appointments.

The government has focused particularly on institutions previously controlled by the S Alam Group, with bad loan recovery task forces working to address the sector’s Tk 4.75 trillion in distressed loans, which is 32% of total outstanding loans.

Foreign investment flows have stabilised following initial uncertainty. While net FDI remained subdued at around $3bn annually, the interim government secured significant commitments, including $2.1bn from China during Mr Yunus’s March 2025 visit. Chinese investment through the Belt and Road Initiative (BRI) continues with over $38bn committed across nine active projects, making Bangladesh the second-largest BRI recipient in South Asia.

Sectoral performance reveals mixed recovery patterns

The agricultural sector faced severe challenges from devastating August 2024 floods that caused over $478m in losses, affecting 5.8m people across 11 districts.

Over 500,000 tonnes of rice production were lost, particularly impacting aman rice production, which is around 38-40% of total annual production.

The agriculture sector in Bangladesh continues to suffer due to the unfair water distribution agreements that the previous governments had concluded with India.

According to the government’s data, the sector employed over 44% of the population in FY 2023-24, while contributing around 11% to the GDP.

The gradual fall in agriculture’s contribution to the economy is not substituted with a vibrant industrial growth, skyrocketing unemployment and pushing labour to migrate to the Global North.

Even after the July Revolution, which was fuelled by the students and youths, mostly from rural backgrounds, the government has not done enough in developing the sector and removing its roadblocks to make it profitable and increase its contribution to the GDP.

Energy sector vulnerabilities have become more apparent post-revolution.

The Bangladesh Power Development Board faced outstanding dues of Tk 420bn (approximately $4.2bn) in 2024, with power sector subsidies reaching Tk 620bn in the current fiscal year.

Under the interim government, despite announcing a new renewable energy policy, Bangladesh faces challenges in meeting its renewable energy goals.

The blue economy presents significant opportunities, with Bangladesh’s maritime territory containing an estimated $120 trillion in ocean resources potential.

Currently contributing approximately 3% of GDP ($6.2bn), the government targets expansion to 9% of GDP by 2025 and 10% by 2030.

Marine fisheries contribute 19.4% of total fish production, according to a 2021 study, with substantial room for growth in coastal tourism, shipping, and offshore energy development.

Climate adaptation requires urgent investment, as climate change poses a significant threat to the South Asian country, according to the Asian Development Bank’s 2023 assessments.

The country needs $12.5bn (3% of GDP) for medium-term climate action, with international support including $1.16bn from the World Bank’s Green and Climate Resilient Development Policy Credit and $50m pledged by Korea.

International relations navigate complex geopolitical landscape

Bangladesh’s international economic relationships have undergone significant recalibration following the political transition.

All major credit rating agencies downgraded the country’s sovereign rating—Moody’s from B1 to B2, while S&P Global and Fitch both cut ratings from BB- to B+—citing political instability and external vulnerabilities as primary concerns.

Foreign exchange reserves covering only 3.3 months of current-account payments and a gross NPL ratio of 9% contributed to these downgrades.

International financial institutions have maintained strong support despite lowered growth projections.

The World Bank, with its largest IDA programme globally, committing $16.4bn across 57 ongoing projects, emphasised the need for “bold and urgent reforms”.

The IMF continues its $4.7bn Extended Credit Facility, approved before Ms Hasina’s ouster in the July Revolution, plus an additional $1.4bn Resilience and Sustainability Facility for climate initiatives.

The Asian Development Bank maintains an $11.02bn sovereign portfolio while projecting recovery to 5.1% growth by FY26.

Meanwhile, regional economic comparisons reveal Bangladesh’s relative resilience.

With GDP per capita at $2,690, the country maintains competitive positioning against Pakistan ($1,471) while nearly matching India ($2,880).

However, both India and Pakistan are experiencing stronger growth momentum during their respective political stability.

The upcoming LDC graduation in November 2026 presents both opportunities and challenges.

Loss of preferential trade access will require strategic adjustments, particularly for the RMG sector’s European Union market access.

এলডিসি থেকে উত্তরণ বিষয়ক পর্যালোচনা সভা অনুষ্ঠিত

— Chief Adviser of the Government of Bangladesh (@ChiefAdviserGoB) July 30, 2025

ঢাকা, ৩০ জুলাই ২০২৫: প্রধান উপদেষ্টা প্রফেসর মুহাম্মদ ইউনূসের সভাপতিত্বে আজ বুধবার স্বল্পোন্নত দেশ হতে উত্তরণের প্রস্তুতি বিষয়ক উচ্চ পর্যায়ের পর্যালোচনা সভা অনুষ্ঠিত হয়েছে। বুধবার বেলা ১১টায় রাজধানীর তেজগাঁওস্থ প্রধান… pic.twitter.com/eIZnOELrWR

The interim government has prioritised negotiations for extended GSP+ preferences and potential FTA discussions with major trading partners.

Reform agenda balances stability with transformation

The Yunus administration has established 11 reform commissions covering the judiciary, elections, administration, police, and constitutional areas, representing the most comprehensive governance overhaul in Bangladesh’s recent history.

These reforms aim to address systemic corruption issues, with efforts to recover $234bn in laundered assets from the previous regime and strengthen institutional accountability.

Anti-corruption measures have targeted the financial sector particularly aggressively.

The Anti-Corruption Commission restructuring, combined with enhanced disclosure requirements and governance standards, signals a serious commitment to transparency.

The government has filed multiple cases against former officials while implementing measures to reduce political influence on banking decisions.

The democratic transition timeline remains critical for sustained economic recovery.

With elections planned between December 2025 and June 2026, the interim government faces the challenge of implementing substantial reforms while maintaining economic stability.

International partners have expressed cautious optimism about the reform agenda, with technical assistance programmes supporting institutional capacity building.

Even amid a global cutdown in the controversial USAID programme, the Donald Trump administration has kept the programme’s support on for Rohingya refugees in Bangladesh.

Looking ahead through transition challenges

Bangladesh’s economic trajectory following the July Revolution demonstrates the resilience of its fundamental economic structures and the effectiveness of pragmatic interim governance. The achievement of macroeconomic stabilisation within one year—particularly the dramatic foreign reserves recovery and inflation control—provides a solid foundation for sustainable growth recovery.

However, structural challenges require sustained attention beyond the political transition. The banking sector’s high NPL burden, energy sector inefficiencies, agricultural vulnerability to climate shocks, and export over-dependence on RMG all demand continued reform focus. The success of the democratic transition by 2026 will largely determine whether the interim government’s stabilisation achievements can evolve into sustained long-term growth.

The international community’s continued support, evidenced by maintained multilateral lending programs and new investment commitments, suggests confidence in Bangladesh’s long-term prospects despite short-term political uncertainties. The combination of immediate crisis management with systematic institutional reforms positions the country well for economic recovery once political stability is fully restored through a successful democratic transition.

Join our channels on Telegram and WhatsApp to receive geopolitical updates, videos and more.